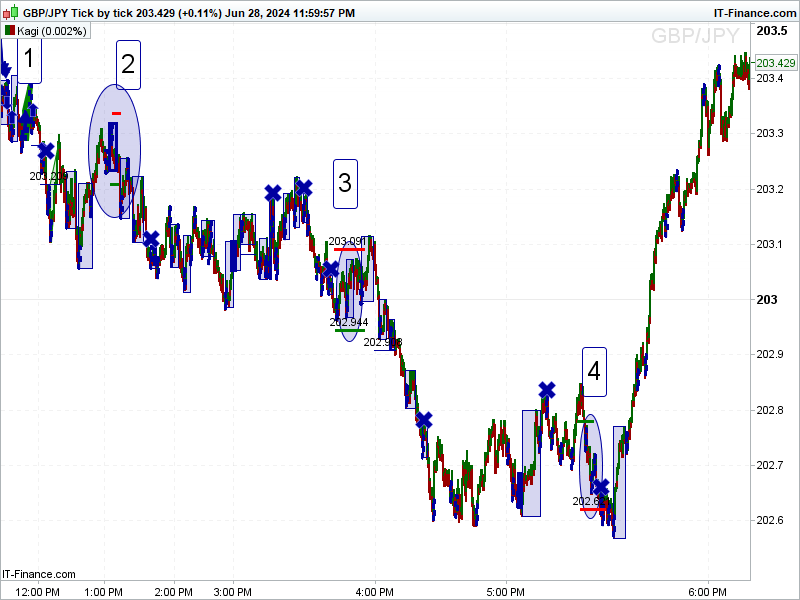

Take a look at the GBP/JPY chart. Initially, it drops from 203.40 to 202.55, and then it rises to 203.45. The descent lasted five and a half hours, and the rise happened in forty minutes. The descent was stepwise with attempts to rise, while the rise was like a rocket, almost before you could get scared. So here’s the task: how to act in this segment? You don’t need to be a genius to guess the answer: we want to sell at point 1 and buy at point 4. ALL methods of analysis are aimed at finding this solution. We spend some time looking for such a solution and we find it!!! But the market changes its dynamics. And we seek a new solution. This takes more time because in this case, we need a solution that will satisfy the new picture while still working for the old one! Time passes and a solution is found, BUT the market changes again and our snowball grows. Solutions take longer to find and become more complex as the number of conditions increases. As a result, they become simply meaningless or impracticable. The idea should be simple, the implementation can be complex, but the idea itself should be simple. I have such a solution, it’s not mine, I took it from the Chinese: “A journey of a thousand miles begins with a single step.” And I applied this approach to the market. In the indicated drawing, I declared that let’s buy. How did I choose the direction? I asked in which hand I held the pen, if the person guessed I would buy, if not I would sell, and the person guessed. From the first to the 4th point, I had 30 entries, or rather 9 attempts to start moving up. Nine first steps. Twice the market did not take more than one step. That is, it’s a pure loss, but very small, just the size of a step. Until 4, we made no more than 3 steps up and only on the 10th try it went up. The fact that we went so far and immediately is a coincidence and it is important to understand this. But such coincidences happen all the time. On the way down, I have such a coincidence between points 3 and 4, and it is much smaller, but the important thing is that it exists! By the way, the rules for choosing the direction do not play a significant role. According to my rules, points 2, 3, and 4 in the ovals are places where my rules tell me where the price should go and only at the second point does it go in the right direction immediately. That is, only a 33% success rate, in other cases, the first opinion is wrong. The secret is not to take it to heart. Change your goal, if the price is 200, you don’t need it to become 220, you just need to earn at least a certain number of points on a certain contract. This is the formula for profit. And of course within a certain period. This is a speculator’s approach. This is not an investor’s approach! But there are few investors among us, an investor is someone who can influence the process, not an audience member hoping that his ticket will be the winning one. Of course, you may disagree, that’s your right. Again, it all depends on how you set the task. If you have questions, feel free to ask, don’t keep it to yourself.

Best regards.